net investment income tax 2021 form

Net Investment Income Tax. On smaller devices click the menu icon in the.

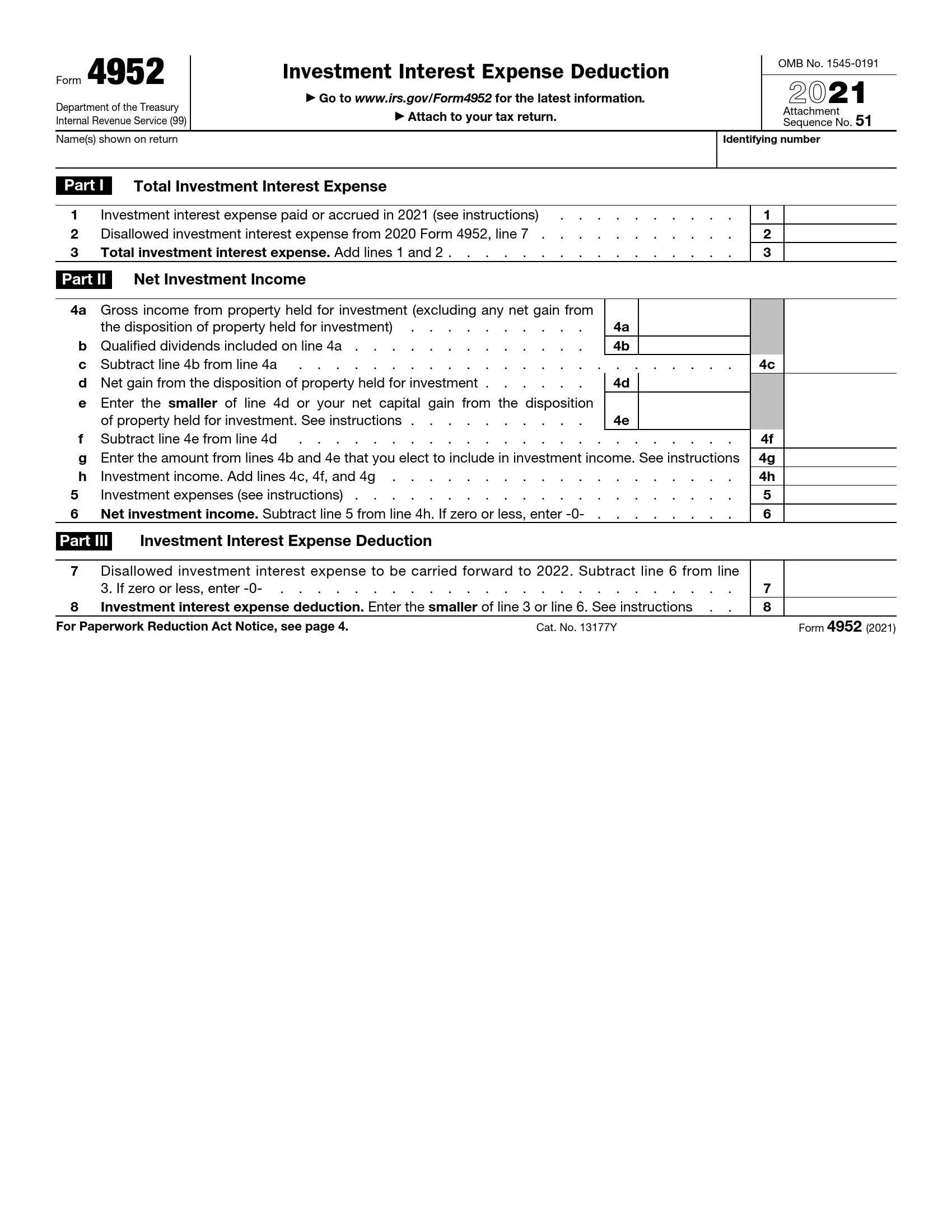

Irs Form 4952 Fill Out Printable Pdf Forms Online

A the undistributed net investment income or.

. NIIT is a 38 tax on the lesser of net investment income or the. Over 50 Milllion Tax Returns Filed. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

You can compute your MAGI by. April 28 2021 The 38 Net Investment Income Tax. Your modified adjusted gross income MAGI determines if you owe the net investment income tax.

April 28 2021 The 38 Net Investment Income Tax. In 2013 a new income tax was added the Net Investment Income Tax. Your net investment income is less than your MAGI overage.

The IRS gives you a pass. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable.

There is a TT oversight regarding form 8960. To make entries for Form 8960 Net Investment Income Tax. 250000 for joint returns and surviving.

Page 1 of 20 740 - 4-Oct-2021. Page 1 of 20 740 - 4-Oct-2021. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers.

June 5 2021 340 PM. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. There is a TT oversight regarding form 8960.

The adjusted gross income. B the excess if any of. To make entries for Form 8960 Net Investment Income Tax.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. A recovery or refund of a previously deducted item increases net investment income in the year of the recovery It does not state. Youll owe the 38 tax.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. If an adjustment is needed to the beneficiarys net investment income for section 1411 net investment income or deductions see below a manual adjustment will need to be made on. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year over the threshold amount Sec.

Net Investment Income Tax. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. You are charged 38 of the lesser of net investment income or the amount by.

TT does not reduce your investment income by. From within your TaxAct return Online or Desktop click on the Federal tab. The threshold amount varies depending on the taxpayers filing status.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. It states on page 11. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service.

A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax NIIT. The Net Investment Income Tax in Practice. Greetings I have a client that was a partner in a partnership that was bought out towards the.

TT does not reduce your investment income by state and local taxes when calculating the investment.

How Are Capital Gains Taxed Tax Policy Center

Net Investment Income Tax Niit Quick Guides Asena Advisors

Do I Need To File A Tax Return Forbes Advisor

Business Tax Quick Guide Tax Year 2021

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Irs Issues Draft Instructions For Net Investment Income Tax Form Wealth Management

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Tax Day 2021 Extended To May 17

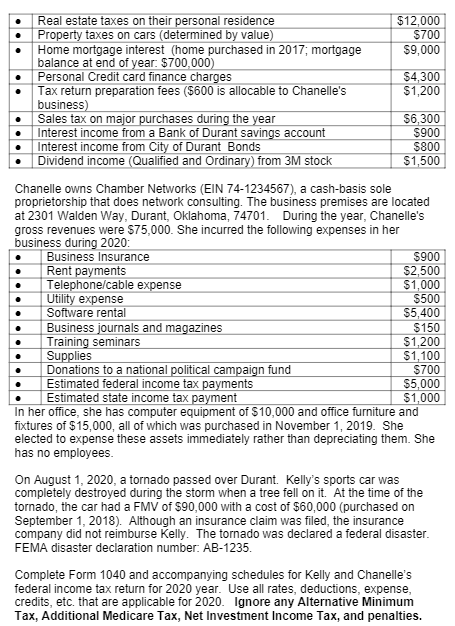

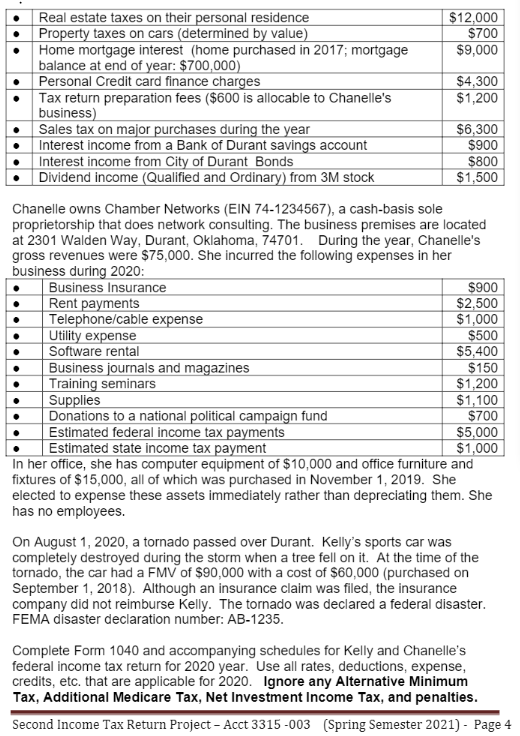

Income Tax Return Project 2 Spring Semester 2021 The Chegg Com

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

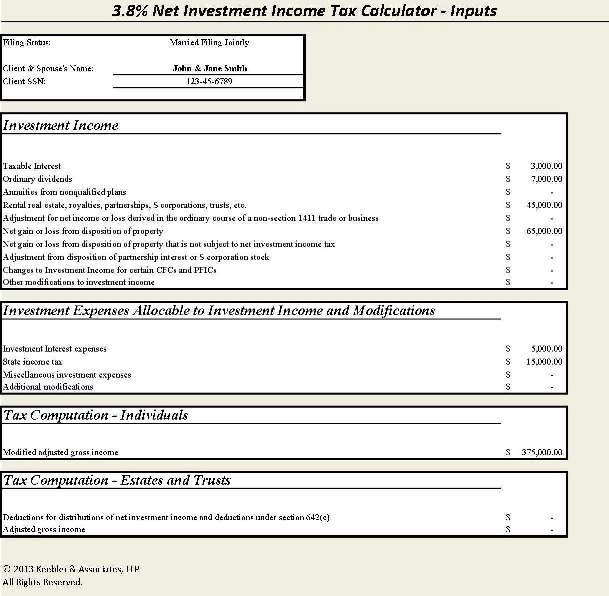

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Got Questions On Your 1099 Tax Reporting Form We Created A Simple How To Read Tax Form Guide That Covers What You Need To Know In Order To Understand What All Those

How Are Dividends Taxed Overview 2021 Tax Rates Examples

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)